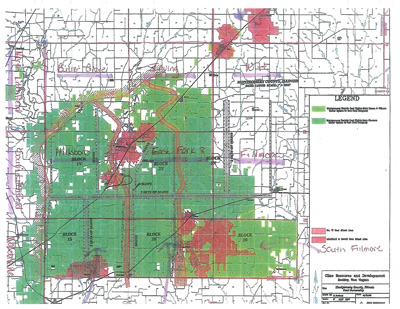

Coal rights location map showing 120,000 acres that were sold by the Montgomery County board to an affiliate of Cline Group.

For the last several years the focus of Citizens Against Longwall Mining has been to minimize the environmental impacts from Deer Run Mine and maximize the community benefits from coal extraction in Montgomery County.

We have identified two primary approaches that would greatly help the economic and developmental growth in Montgomery County.

- A coal severance tax should be established in Illinois.

- The royalty rate per ton of coal extracted from Deer Run Mine should be increased.

It is hard to understand why Illinois is one of the few coal mining states that do not have a severance tax. West Virginia has a 6.5% and Wyoming a 10.6% coal severance tax. Some Illinois communities have shown their support for a coal severance tax. The Montgomery County Board passed a pro-severance tax resolution during Roy Hertel’s chairmanship. Benld City Council has also approved a resolution to establish a coal severance tax in Illinois. To date, unfortunately, the State of Illinois is more supportive of profits for the coal operator than promoting the needs of coalfield communities.

One proposed plan for a coal severance tax in Illinois was for one-third of collected revenue to go to coal extraction communities, one-third to the state general revenue fund, and one-third to a permanent legacy fund that would cover costs later after the coal companies are gone. There is abundant evidence to support the need for this proposal. There have been two schools destroyed by subsidence in our area, Benld, several years ago, and Swansea, this September, 2017. A legacy fund would have helped communities with expenses like school replacements and repair of damaged infrastructure.

Past experiences show that communities cannot depend on Illinois government agencies and legislators to go against the interests of the coal-utility complex. People power is the most effective way to address the needs of communities. To unite and inspire citizens to act in their own best interests, they must be made aware of the past and consequences that are occurring now and in the future.

Montgomery County and Hillsboro were horribly short-changed when the coal bargaining terms were set up. The coal rights for 120,000 acres were sold by the Montgomery County Board for only $7.2 million to an affiliate of Cline Group in December 2004. This group turned around a short time later and resold the coal rights to another Cline affiliate for $255 million or about 35 times more than initially sold by the Montgomery County Board!

The 2% royalty rate is also too low for any growth potential in Montgomery County. In fact, the 2% is really about 1.5% to the county after Deer Run Mine’s required payments like Black Lung, Abandoned Mines, transportation costs, etc. are subtracted.

In yet another case with questionable results between citizens of a community and the giant coal industry, the citizens of Hillsboro lost their airport and failed to receive fair compensation for this loss. The airport was not appraised as a certified, functioning airport, resulting in an appraisal far below replacement value. The Hillsboro Airport was sold to Hillsboro Energy LLC for $350,000 on January 9, 2008 with the stipulation that the airport would be replaced within 10 years. There still is no Hillsboro airport or plans in the making to construct one.

Citizens are at risk of losing money in more subtle ways. The permanent placement of two high-hazard coal slurry impoundments, the violations of the Clean Air and Clean Water Acts, subsided farmland, and compromised roadways caused by Deer Run Mine are bound to adversely affect property values in Montgomery County. The community is not sharing in the wealth from coal extraction, and these companies should pay back to communities they have adversely affected. Our schools and communities are not receiving the funding that they need to provide 21st century opportunities.

Harm is caused to coalfield communities in many ways, and some are unexpected, but extremely dangerous. Deer Run Mine is sealed due to an ongoing fire that has been burning since March 2015. Even though Deer Run Mine is inactive, Hillsboro Energy LLC applied to the Illinois Department of Natural Resources, Office of mines and Minerals for a 7,731.8 acre expansion in 2015. IDNR/OMM has not approved or denied the permit application.

The underground fire has not been extinguished after several attempts and should be a major concern to everyone in Montgomery County. There seems to be no accountability for the community’s safety. This ever present danger to the community must be in the forefront of communications with the mine. Citizens need to know where the fire is located since Deer Run Mine is located in the City of Hillsboro. Is the fire migrating and in what direction?

When the Hillsboro Zoning Board of Appeals amended the land use plan to allow underground coal mining, the stated reason for the zoning change was “…to promote economic growth of the community, conserve property values, and protect the health, safety, and welfare of the citizens of the City of Hillsboro, Illinois…†Instead, much the opposite has resulted, our community continues to struggle financially and area citizen’s health and safety are at greater risk. For improvement and growth in Montgomery County, residents must unite and work toward a community benefit plan that holds coal operators responsible to the region in a way that enhances the quality of life for all.